Accelerating lending lifecycle through rapid test automation

Overview

Our client is a US-based diversified financial services company. Their vision is to meet the evolving needs of their customers by providing reliable guidance. They offer a wide range of retail banking products and services, catering to one out of every three households in the US. HCLTech assisted them in developing and implementing a reusable testing automation framework across the lending lifecycle to accelerate the time-to-market of their IT capabilities.

The Challenge

Complex test case scenarios and multiple dependencies hinder productivity

Their existing lending process had multiple gaps, and the client was facing various challenges that needed to be addressed to enable the evolution of an efficient, secure lending process. The traditional process was time-consuming leading to increased processing time. Some of the challenges faced by the client included:

- Limited documentation on the existing framework

- Dependencies between modules and sub-modules

- Prerequisites for factory model-led test automation were not met

- Test cases were not ready for automation

- Multiple dependencies on various stakeholders for module and submodule

- Test scenarios were extremely complex due to multiple dependencies on application data flow elements

The Objective

Enhance productivity through automation for a smooth lending cycle

Our client aimed to develop and implement a reusable testing automation framework across the lending lifecycle, including loan origination, loan servicing and loan collections.

Key components of the objective were:

- Adopt a rapid regression automation framework

- Create a reusable framework across testing

- Improve productivity through automation

- Automation of 3,800+ manual test cases across loan origination, loan servicing and loan collections application landscape

The Solution

API-based automation model to accelerate rapid implementation

HCLTech proposed and implemented a hybrid operating model to transform the testing landscape.

Scope of the solution

- Home lending

- Personal lending

- Commercial lending

Solution levers

- Sprint-based agile delivery of automation scripts

- Customized “know-how” documentation or handbook for each automation module

- Multiple workshops were planned for the clients

- Effective test management through daily progress reporting

- Collaboration from automation testing and domain CoEs

- Distributed agile factory model leveraged for seamless operations

For a major set of functionalities, HCLTech implemented an API-based automation model to accelerate rapid implementation. A focused governance model was also implemented to enable a response to outstanding queries from the SMEs at the functional module level. This formed the backbone of effective program management to track the aging of various queries and provide an approximate timeline for the completion of test automation for the respective lending modules.

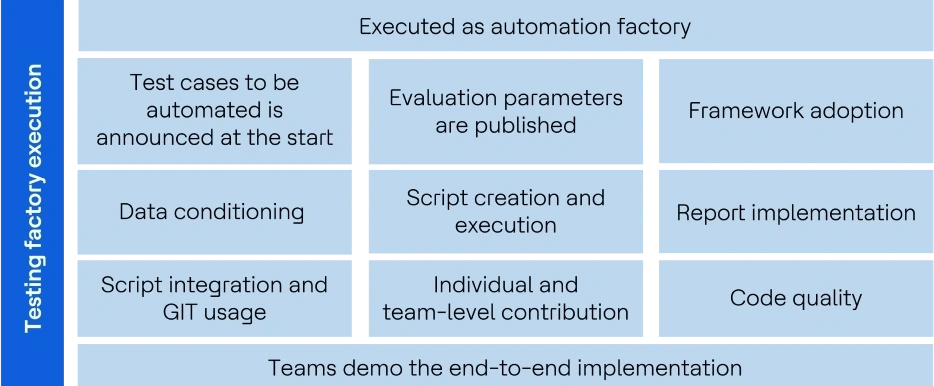

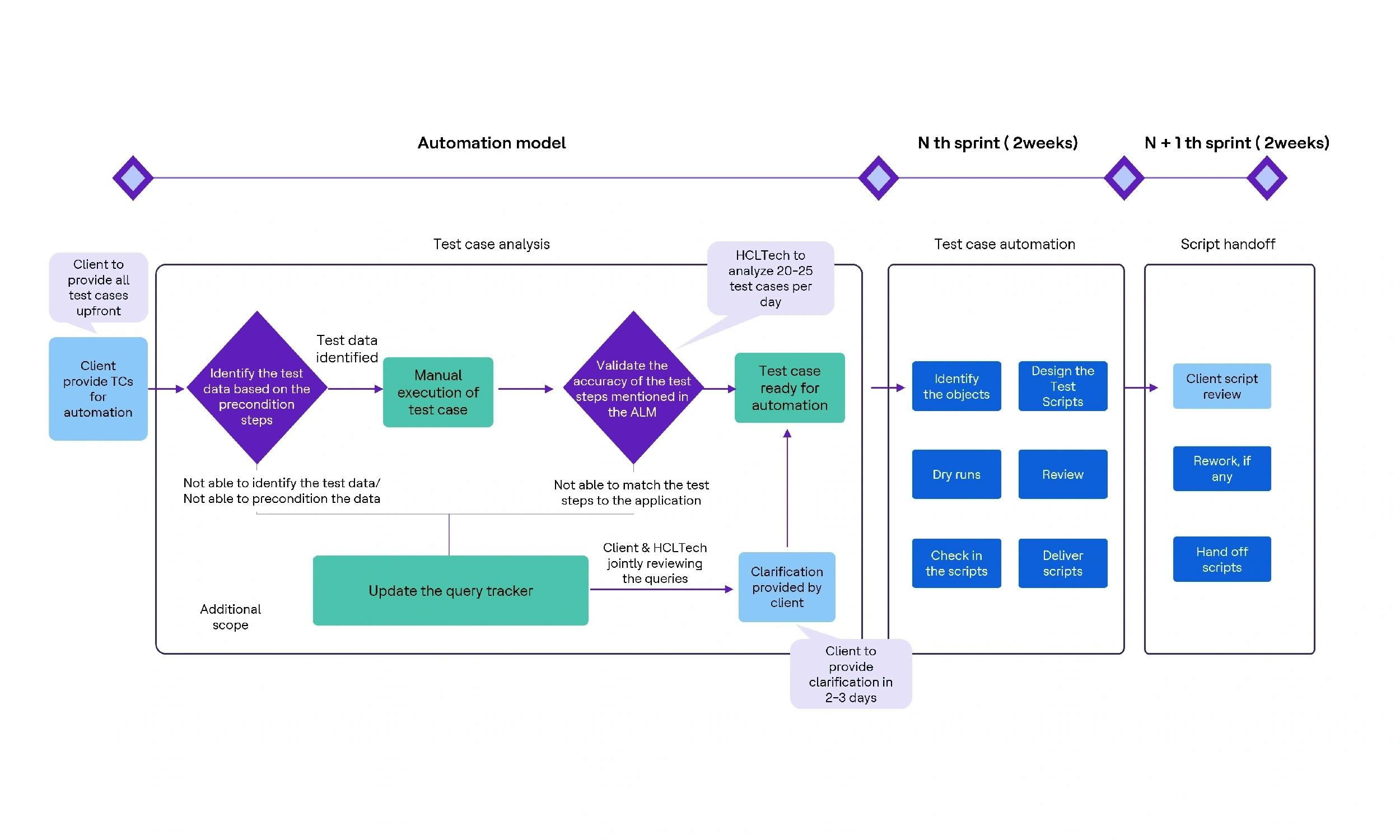

A view of the automation model:

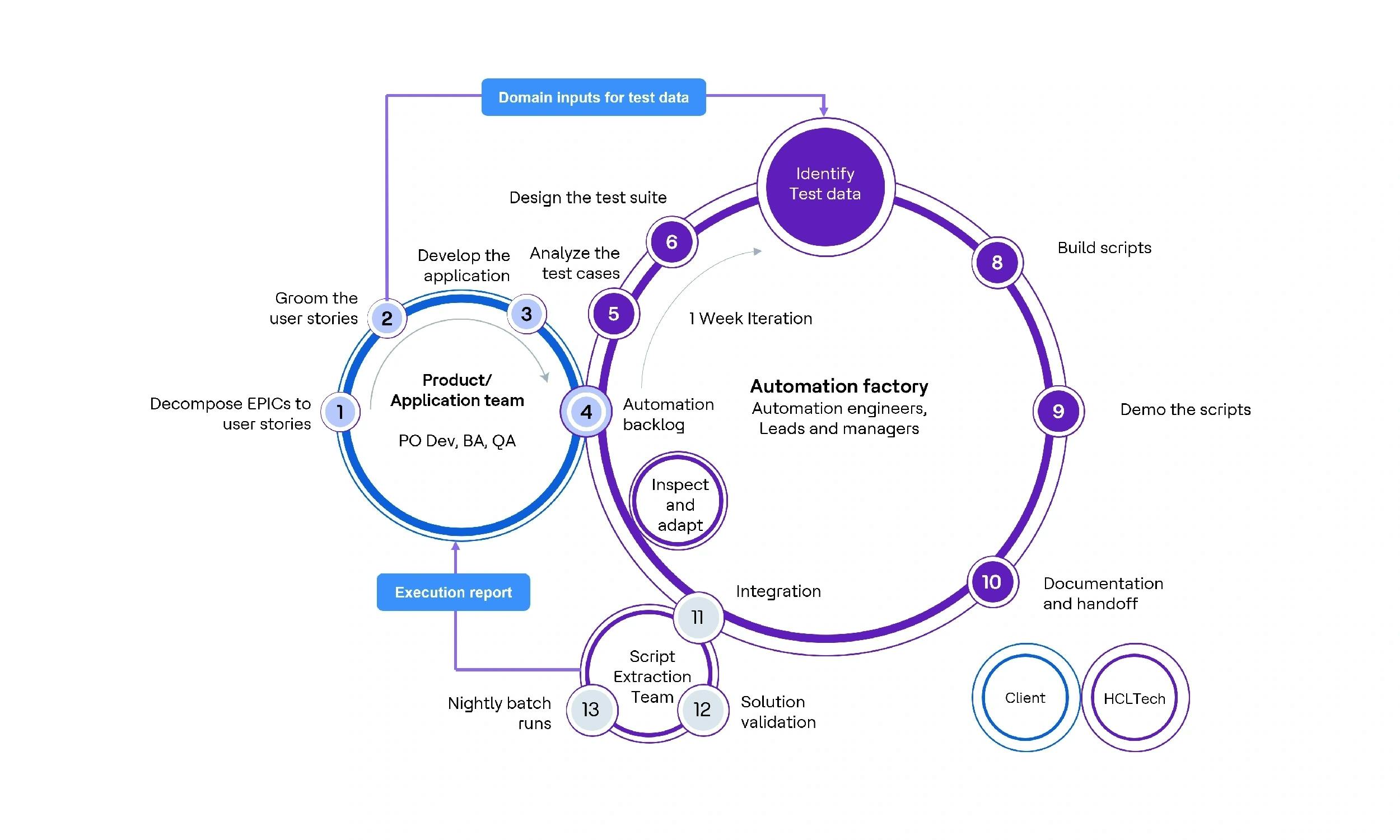

The following representation provides an end-to-end lifecycle view of the various steps involved in the automation of the test cases across the lending landscape. HCLTech adopted a KPI-driven approach to successfully execute the transformation program. Key metrics, such as adherence to functional and technical standards, schedule adherence, automation rate and defect closure were monitored throughout the program delivery to provide value-led outcomes to our client.

- Outcome based Managed Capacity Model

- Client’s resource capacity available for higher value planning and control activities

- HCLTech owns execution including people management, productivity and quality

- HCLTech does proper hand-off to client’s team with detailed KT documentation

HCLTech adopted the following model to accelerate the adoption of the automation framework.

The Impact

Streamlined work processes with significant cost reduction

- 78% reduction in the time required to test a particular functionality

- Replacement of monotonous manual regression test cases with automated alternatives

- 30% reduction in the overall cost of quality

- Return on Equity (RoE)-based benefits increased by up to 60%

- Development of a reusable test automation solution that could be adopted across various products within the client's landscape

- Delivery of a comprehensive closure report that includes a detailed code merge request and screenshots for the audit trail

By integrating the testing automation framework into the lending process, HCLTech helped our client enhance operational efficiency, regulatory compliance and ultimately provide a more seamless experience for their end customers.